nj tax sale certificate premium

Again in a New Jersey tax sale the property is sold at a public auction subject to the right of redemption to the person who offers the lowest interest rate on the tax debt which cant exceed 18. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is.

Renewal Of Registration Certificate For Your Vehicle Road Tax Learn Drive Vehicles

Once the bidders bid down to 0 it will go into a premium starting at multiples of 100.

. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law. Bidding stops to obtain the tax sale certificate. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the original tax lien certificate in addition to any interest rate on the certificate.

In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24. To accept a New Jersey Resale Certificate the supplier must be registered with the State. State of New Jersey Division of Taxation SALES TAX FORM ST-3 RESALE CERTIFICATE Purchasers New Jersey Taxpayer Registration Number To be completed by purchaser and given to and retained.

The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. New Jersey Tax Lien Auctions. Acceptance of bond note other obligation as consideration for sale of certificate 545-1132.

If you are served with a foreclosure complaint or wish to pursue a claim on a tax sale certificate please call us at 973 890-0004 or e-mail us to see how we can assist you. Here is a summary of information for tax sales in New Jersey. Sales and Use Tax.

New Jersey is a good state for tax lien certificate sales. Elements of Tax Sales in New Jersey. Sales and Use Tax Forms.

At the conclusion of the sale the highest bidder pays the outstanding. Bond note obligation deemed asset of municipality 545-1134. Its the only state where the interest rate on the certificate amount is bid down to 0 and then premium is bid.

New Jersey is really a different animal. 18 or more depending on penalties. Sales and Use Tax.

Tax sale certificates can earn interest of up to 18 per cent depending on the winning percentage bid at the. Interest on subs is 8 per annum until 1500 is owed then its 18. The municipality has to give you back your premium of 1000000.

The New Jersey Supreme Court in In re. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality.

Tax liens are also referred to as tax sale certificates. Thats 5000 lien amount 200 4 redemption penalty 1000000 subsequent taxes 240000 24 of subs 17600. The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate.

What is sold is a tax sale certificate a lien on the property. Bids that reach 0 then go to premium bids. Dates of sales vary depending on the municipality.

The premium is returned to the investor should the lien redeem but no interest is paid on the premium amount. Delinquency on a property may accrue interest at up to 8 for the first 150000 due and 18 for any amount over 150000 If the delinquency exceeds 1000000 at the end of a municipalities fiscal year there may be an addition 6 penalty. The New Jersey Technology Business Tax Certificate Transfer program enables qualified unprofitable NJ-based technology or biotechnology companies with fewer than 225 US employees including.

But if at the sale a person offers a rate of interest less than 1 or at no interest that person may instead of an interest rate offer a premium over the tax amount due including. 545-113 Private sale of certificate of tax sale by municipality. If you bid premium and most liens in New Jersey are won at high premiums you dont get any interest on the certificate amount however you do get interest on the subsequent tax payments.

Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. 545-1 to -137 a purchaser of a tax sale certificate acquires a tax lien not a lien securing the property owners obligation to pay the amount owing to redeem the certificate. Princeton Office Park LP.

Removal of lessee tenant 545-1133. NJ Soldiers Sailors Relief Act of 1979. If a bid made at the tax sale meets the legal requirements of the Tax Sale Law the municipality must either sell the lien or outbid the bidder.

Recording of assignments service on tax collector. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services account may submit a paper application Gtb-10 for business. By selling off these tax liens municipalities generate revenue.

Third parties and the municipality bid on the tax sale certificates TSC. Tax Sale Procedure How does it work Purchasing a tax sale certificate is a form of investment. Private sale of certificate of tax sale by municipality.

Tax sales are conducted by the tax collector. You will find that very high premiums are paid for NJ tax liens. The purchaser must complete all fields on the exemption certificate in order to claim the exemption.

Payments at Sale. Creation and issuance of Tax Sale Certificates within 10 days day of sale is 1st day. Real Estate and Tax Law.

Sales Tax Collection Schedule 6875 effective 01012017 through 12312017. Recording of assignments service on tax collector. When a municipality has or shall have acquired title to real estate by reason of its having been struck off and sold to the municipality at a sale for delinquent taxes and assessments the governing body thereof may by resolution authorize a private sale of the.

The lien holder pays the debt owed to the municipality by the assessed owner of the property and in return is guaranteed the interest rate on the amount paid when the lien is redeemed. Completed New Jersey Resale Certificate Form ST-3 or Streamlined Sales and Use Tax Agreement Certificate of Exemption Form ST-SST. If you invest in tax sale certificates be mindful of the complexities of the governing state law when you file a bankruptcy proof of claim on account of the certificate.

The premium is kept on deposit with the municipality for up to five. Ignoring the law may cost. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

Hvac Maintenance Contract Template Awesome Hvac Proposal Proposal Plan Sample Hvac Bid Proposal Invoice Template Contract Template Business Plan Template

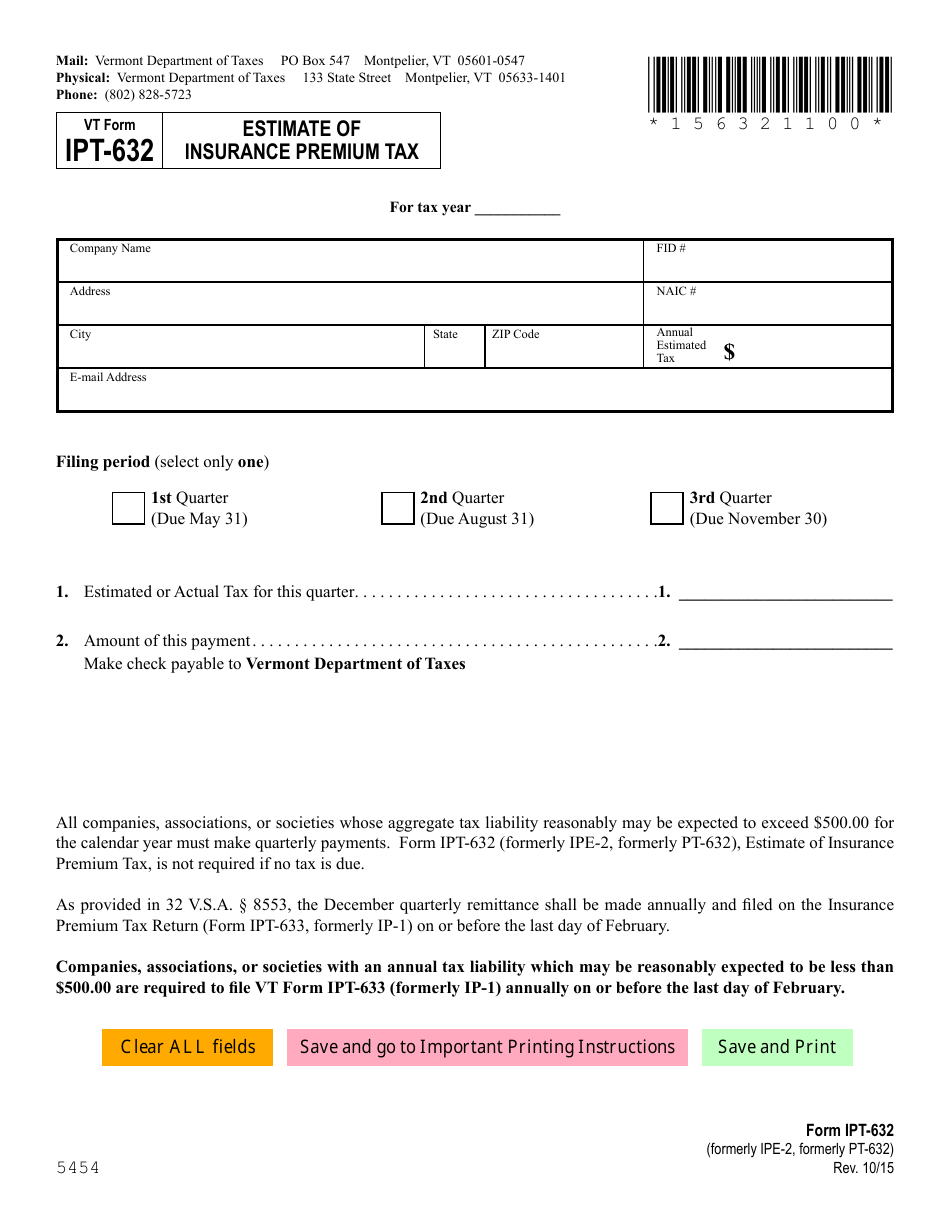

Vt Form Ipt 632 Download Fillable Pdf Or Fill Online Estimate Of Insurance Premium Tax Formerly Ipe 2 Formerly Pt 632 Vermont Templateroller

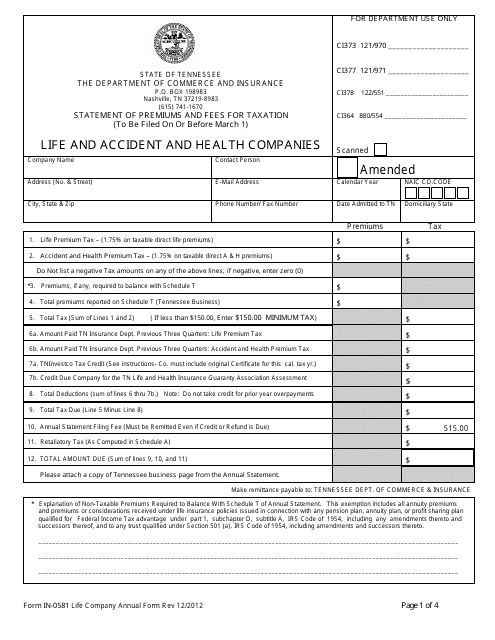

Form In 0581 Download Printable Pdf Or Fill Online Statement Of Premiums And Fees For Taxation Life And Accident And Health Companies Tennessee Templateroller

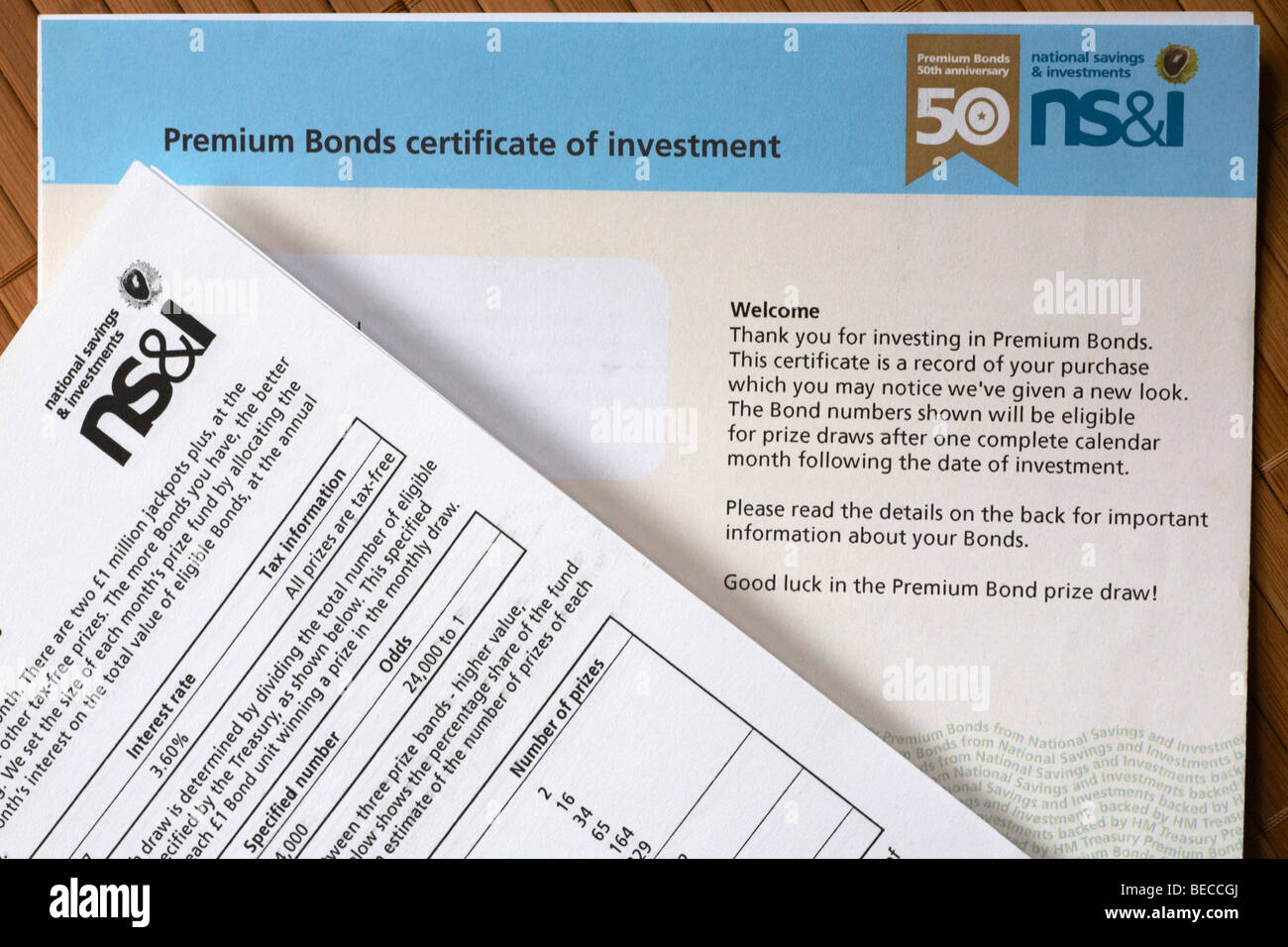

Bonds Certificate High Resolution Stock Photography And Images Alamy

Browse Our Image Of Electronic Funds Transfer Deposit Form Template For Free How To Be Outgoing Id Card Template Strategic Planning Template

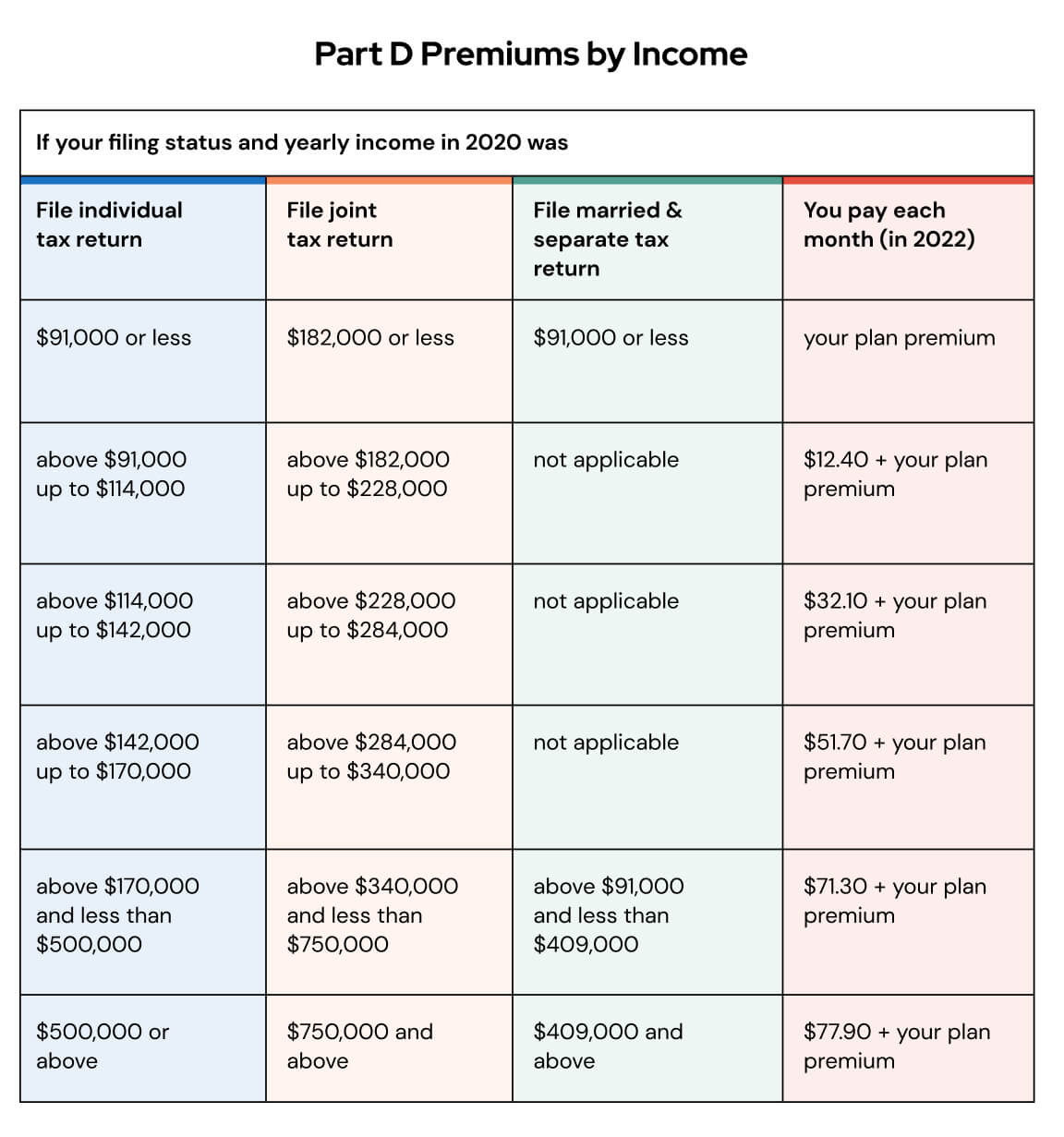

Income Related Monthly Adjustment Amount Irmaa

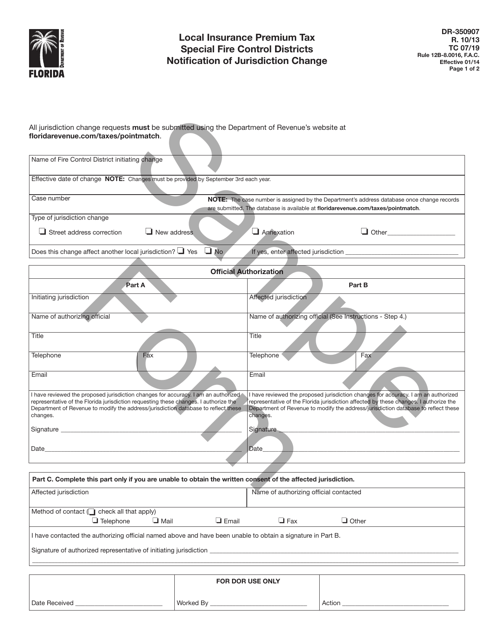

Form Dr 350907 Download Printable Pdf Or Fill Online Local Insurance Premium Tax Special Fire Control Districts Notification Of Jurisdiction Change Florida Templateroller

Form Pf 2 Download Fillable Pdf Or Fill Online Insurance Premium Finance Company Renewal Delaware Templateroller

How To Appeal A Higher Medicare Part B Premium Boomer Benefits

Windows 7 Home Premium Sp1 32bit Oem System Builder Dvd 1 Pack For Refurbished Pc Installation Recomended Microsoft Software Microsoft Windows Microsoft

How Annuity Products Are Taxed And Regulated By State

Income Related Monthly Adjustment Amount Irmaa

Premium 2bhk At Price Of 1bhk Peaceful Life One Life Blue Water

Are You Bidding Premium For Tax Liens Tax Lien Investing Tips

Floorlot Flooring 3 In 1 Premium Flooring Underlayment 3mm 200 Sq Ft Roll Reviews Wayfair

Notarized Identity Verification Id Card Template Templates Card Template